Secure Your Retirement With America’s Most Reliable Pension Alternative1

Personal Pension Accounts provide predictable, lifelong income—without stock market risks or hidden fees.

No strings attached. In order to see if you can qualify for a Personal Pension Account, we need to crunch your numbers in a way that nobody has done for you before, a process that only takes 15 minutes. There’s no obligation at the end, and you’ll leave with peace of mind.

How does a PPA work?

A Personal Pension Account (PPA) is a retirement savings vehicle designed to guarantee steady income for life while shielding your nest egg from market losses. Unlike 401(k)s or brokerage accounts, a PPA cannot lose money to market downturns and never charges annual management fees.

Guaranteed Income

Receive dependable monthly deposits you can’t outlive.2

0% Floor

Your account value is protected—market declines cannot reduce your principal.3

No Annual Fees

Keep more of what you earn.4

Tax-Deferred Growth

Pay no taxes on gains until income begins, helping your savings compound faster.5

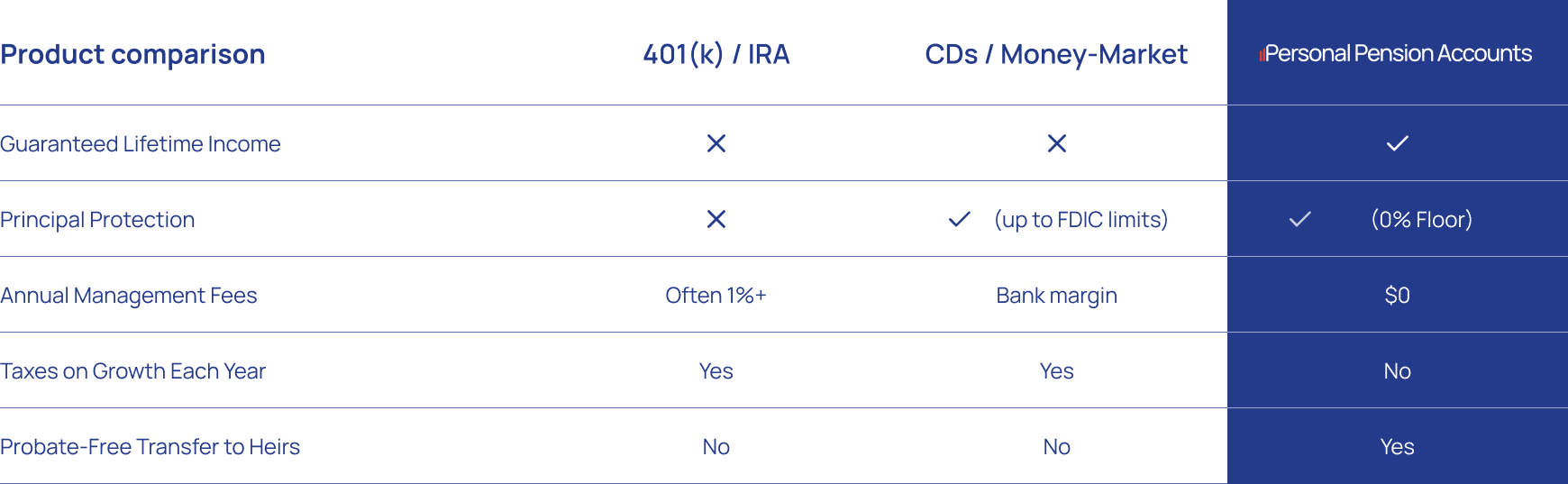

How Does A PPA Compare To Traditional Options?6

A Personal Pension Account combines the safety of bank products with the lifetime income retirees once enjoyed from company pensions.

Why Are Americans Choosing PPAs For Secure Income?

29% More Income

Those with PPA gain 29% more income.7

33% Less Risk

Individuals with PPA reduce their downside risk by 33%.7

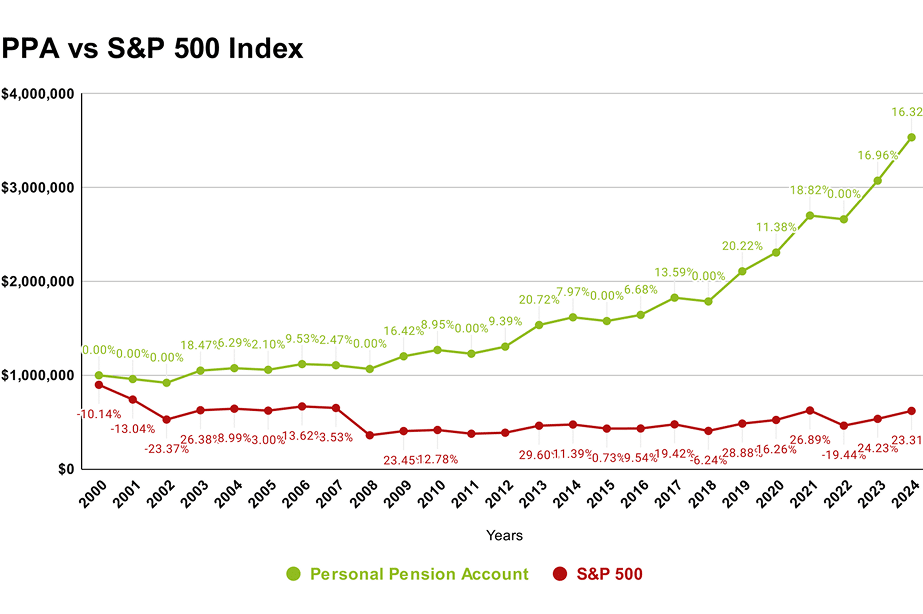

How Important Is the 0% Floor?8

How It Works9

1

Qualify

2

Customize

3

Activate & Relax

Customer Testimonials

Priscilla L.

I regretted my 401(k), but now I don’t have to worry because of a Personal Pension…10

David K.

Cheryl & Dave B.

John R.

Frequently Asked Questions

How safe is a Personal Pension Account?

What if I pass away—does the money disappear?

Can I access funds early?

Will my income keep pace with inflation?

Are there hidden fees?

How Does a PPA compare to traditional options?

With a 401K, IRA, TSP:

❌ Your growth & principal is not guaranteed (most 401(k)s rise & fall with the market)

❌ You’re expected to shoulder all the risk

❌ You have limited/no access to professional advisors (or you’re not seeing a return on your costly advisors’ fees)

❌ You and your spouse aren’t guaranteed a dime of life-long income

With a Risk-Free PPA:

✅ Your interest rate can be guaranteed. (You can count on consistent annual growth — even if the market crashes)16

✅ You activate life-long income and shoulder none of the risk (just like pensions used to offer)

✅ You can access a new account bonus (to help you recover from some or even all of your losses)17

✅ You get access to exclusive investment strategies normally reserved for only the wealthiest families in America18

If PPAs are so great, why hasn’t my financial advisor ever told me about this?

REASON 1: Most financial advisors don’t know Personal Pension Accounts (PPA) exist – nor how to structure one that maintains a tax-advantaged status for the account holder.19

REASON 2: Most financial advisors only recommend the financial vehicles their company tells them to recommend.

REASON 3: Most financial advisors don’t know how to remove your risk while making your assets grow.

Who are PPA investment strategies provided by?

Who is PPA for?

Do you keep crunching the numbers and pushing your retirement dreams back year by year?

Do you have an underperforming 401K, IRA, TSP?

Yes? Then a PPA could be right for you! But to know for sure, you need to click below and drop us a note.

Want The Financial Benefits of a Pension?